Are your Employees Really Independent Contractors?

The issue of employee v. independent contractor is an issue that never seems to die. Many employers decide to classify workers as independent contractors because they don’t want to deal with issues like paying the other half of social security tax and Medicare tax, or having to provide benefits. Sometimes, employers do it because it is easier to terminate an independent contractor than it is an employee.

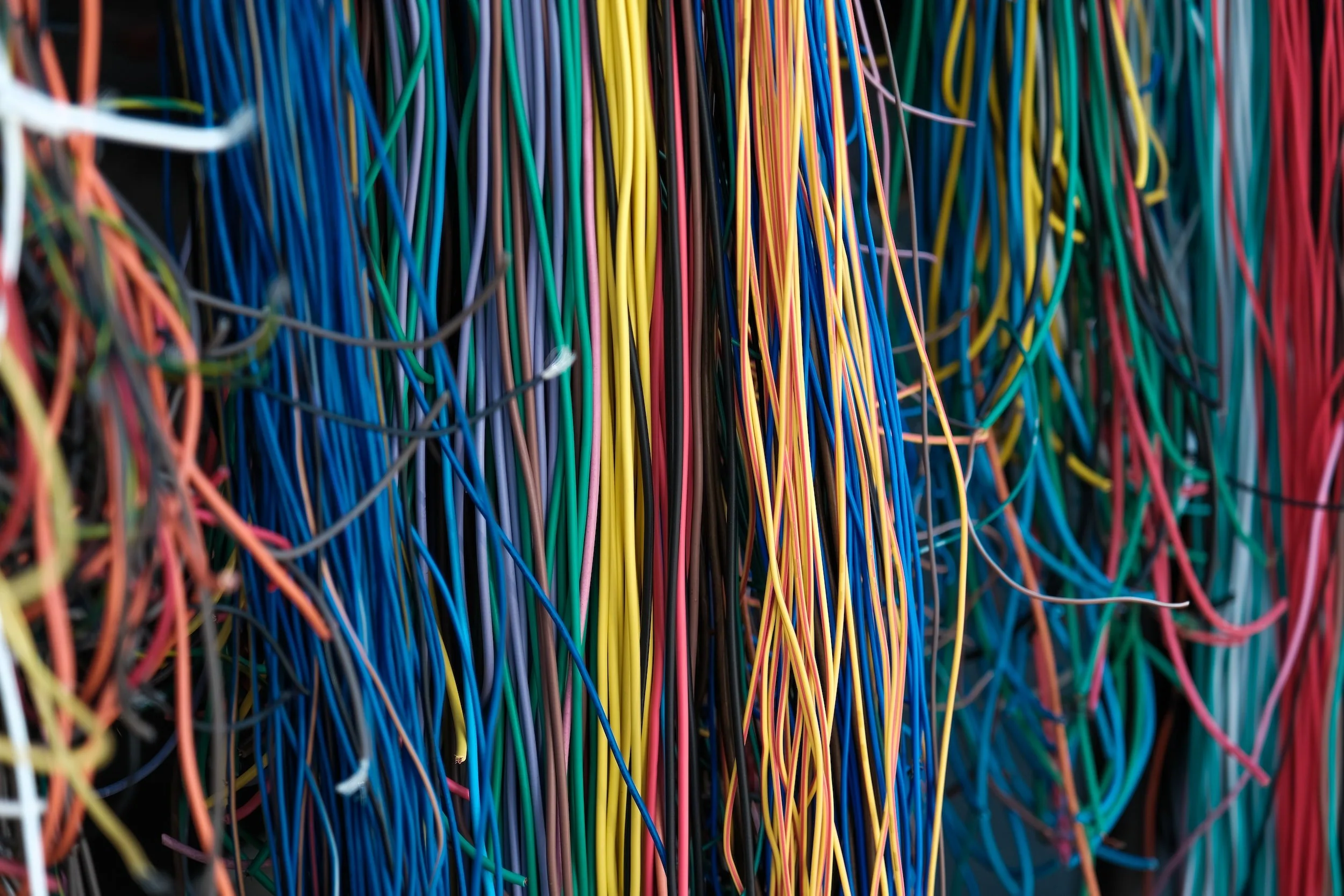

But an Ohio company called Ugicom Enterprises ran into the buzz saw that is the Bureau of Workers’ Compensation. Ugicom, an underground cable installer, was audited by the BWC which determined that Ugicom had exerted too much control over the workers. As the Ohio Supreme Court noted that the control test is not a bright line test, but an analysis of a significant (and nonexhaustive) list of factors.

The factors included:

Was the work a part of the regular business of the employers?

Were the workers engaged as independent businesses?

How were the workers paid?

How long were the workers employed?

Were there written agreements/contracts?

Did the parties think they were in an employment relationship?

Did the business provide the tools necessary to perform the work?

Were these skilled tasks?

Ultimately, the Ohio Supreme Court agreed with the BWC’s determination that Ugicom mischaracterized its workers. Ugicom was charged almost $350,000 in premiums by the BWC as a result.

To read the court’s decision, click here.